State senators are still working on their budget bill this week, and it may take until the week of May 15 for them to make it public and vote on it. One factor potentially holding it up is the final tally of personal income tax collections, known as the “April surprise.”

Business owners and individual contractors do not pay regular withholding taxes, though they do pay estimated taxes once a quarter. If taxpayers have a good business year or reap capital gains on their investments, they are more likely to owe money to the state, which leads them to delay as long as possible filing their taxes and making their final payments. If they had too much withheld, they file early to get their refunds. As a result, April income tax collections over the past ten years have roughly doubled average monthly collections compared to the rest of the year. The range has been from 44 percent higher in 2010 to 169 percent in 2007. And that’s the surprise.

Revenues this year have been about 3 percent above forecast and above last fiscal year. It is still too early to know the full effects of tax reforms since 2013, but if this April matches last April, final income tax collections could beat projections by $700 million. Income taxes remain about half of total revenue, as they have been for most of the past decade.

A surprisingly good April will make legislators more comfortable with cutting taxes and spending more today and preparing for economic downturns and meeting obligations to state retirees in the future. Rep. David Lewis seemed to expect a pleasant surprise when the House and Senate unveiled their competing tax plans last month, saying “We might even have a larger than $1 billion tax cut.”

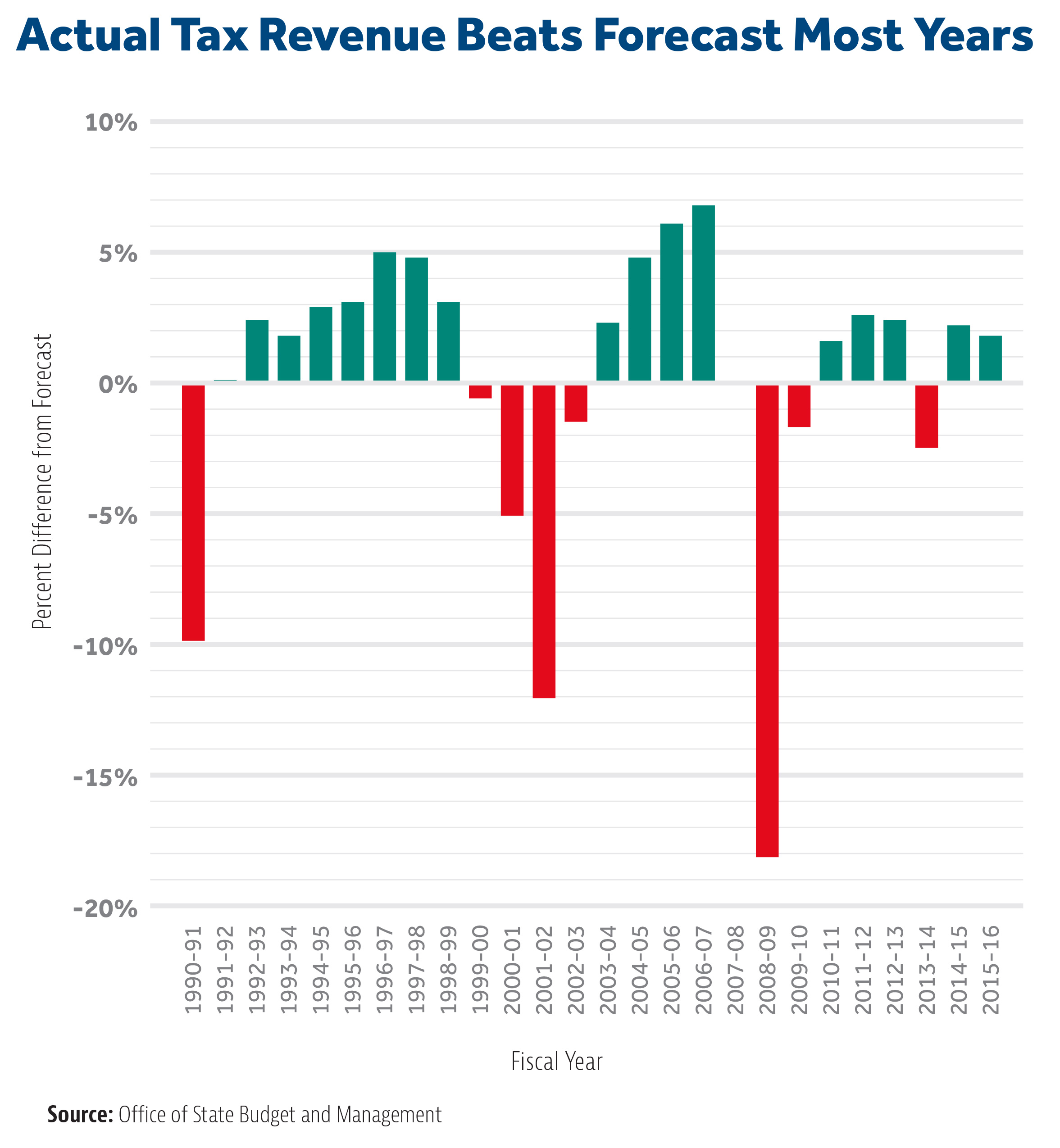

Slow and steady economic growth, however, mitigates against big surprises. During the economic expansion of the 1990s, state tax revenue beat expectations by 2.9 percent on average. That expanded to an average 5.0 percent during the expansion of the 2000s. When recessions hit, revenues missed by even larger gaps, off by 9.9 percent in 1991, 12.1 percent in 2002, and 18.2 percent in 2009. Since 2011, actual collections have exceeded budget projections by 2.1 percent, except when tax reform took effect in 2014 and withholding changed, but the April total that year turned a looming crisis into a minor dip.

One thing you may have noticed about that previous paragraph, that is, if you made it through the numbers, is the remarkable consistency of positive surprises outside of recessions. For that, the revenue forecasters at the governor’s Office of State Budget and Management and the General Assembly’s Fiscal Research Division deserve a great deal of credit. Unlike budget forecasters in other states, they have made conservative projections that have prevented midyear budget crunches when revenues did not meet expectations. Their work has taken some of the suspense out of April revenue collections but none of the significance.

Postscript

Not everything can be measured in dollars. Mark Binker was one of the people who made working around state government enjoyable. He was personable, polite, and professional at all times. Mark knew everyone and could get information nobody else knew existed, then gladly shared what he knew with anyone who asked. His passing last Saturday leaves the rest of us poorer, but his time on earth made us all richer. It has been remarkable and reassuring this week to see the appreciations of Mark and his work from all corners of the state and both sides of the aisle.