As the 2020 election season gathers momentum, North Carolina’s tax reforms and demands for higher spending on any number of government programs will be front and center. One example is a recent editorial in both the Charlotte Observer and the Raleigh News & Observer that was full of specious arguments about the results from North Carolina’s tax cuts and spending restraint.

My colleague Jon Sanders already covered some of the editorial’s logical and factual problems. Not only does North Carolina receive high marks from the business press, but the Tax Foundation has cited North Carolina as a positive counter-example to Kansas’ flawed tax cuts. We’ll continue with actual economic performance

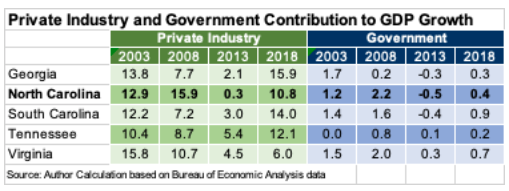

From 2008 to 2013, North Carolina’s economy shrank 0.3 percent adjusted for inflation, the 10th worst economy in the country. From 2013 to 2018, the state had the 15th fastest growth in the country, though not as strong as some of our neighboring states. People continue to come to North Carolina, as well, attracted by low taxes and regulations and helping fuel economic growth.

Government spending contributed more to North Carolina GDP growth from 2003 to 2008 than in any of our neighboring states, but when the recession came, it pulled down the economy more than in those other states. All states had slower government growth from 2013 to 2018 compared to a decade earlier (see below). For North Carolina, this slower growth of government and increases in savings (or unspent cash balance) should leave the state less vulnerable to another round of sales tax hikes or spending cuts like those imposed every other year between 2001 and 2009.

The editorial paraphrases Michael Mazerov from the left-of-center Center for Budget and Policy Priorities, “What drives state economies, he said, is state spending on education, transportation and amenities such as parks.” Good investments in education and roads are not simply about spending more or less. We will set road spending aside for now. It’s almost not worth mentioning parks, in part because parks and recreation receive just a penny of every dollar spent by state and local governments, but more because local governments spend seven times as much on these services than state government.

On education, other considerations besides the level of spending include the cost of living in a city or state and whether the money is for instruction or support services. There are also the results of spending. For example, in 2016 Louisiana spent $11,038 per pupil, West Virginia spent $11,291, and North Carolina spent $8,792. Would the McClatchy papers or Michael Mazerov suggest West Virginia or Louisiana schools are getting good value for the extra $2,300 to $2,500 per student? Would they prefer North Carolina mimic the spending and educational results of those states?

Governments around the world seek to ease the regulatory burden by reducing the number of regulations, exempting some companies from regulation or simplifying compliance mechanisms. The World Bank, following Hernando de Soto, measures the time to start a business. Arizona State University’s Center for the Study of Economic Liberty has adapted the methodology for the largest cities in North America, and Charlotte ranks sixth. Good regulation is not simply about more or less.

International comparisons make clear that when governments have to choose between lower spending and higher taxes, as North Carolina must do every year, spending restraint is better for the economy than tax hikes. The value of low taxes and low spending with high saving may not be fully known until the next recession, but the approach has been far from the failure that the McClatchy papers claim.