Since the end of the 1998 legislative session, critics of the past four years of modest — and welcome — tax relief in North Carolina have been working hard to promulgate a myth. The myth is that the state’s efforts to reduce taxes have been excessive and are now presenting the 1999 state legislature with a severe budget crisis. Senate President Pro Tem Marc Basnight has even suggested that the state may have to consider tax hikes or a lottery as a result of cutting taxes “too deep.”1

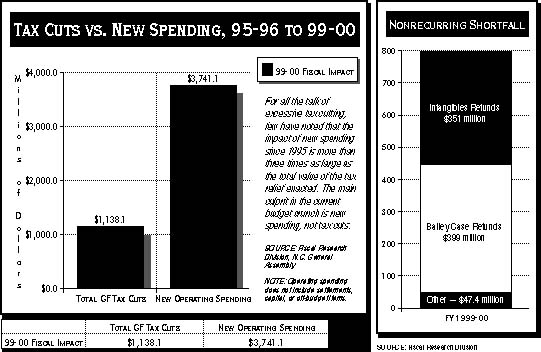

This is absolute nonsense. As official budget statistics clearly show, the General Fund tax relief of the past four years will have a combined fiscal impact in 1999-00 of about $1.1 billion. But during the same period, rapid spending growth added $3.7 billion to the state budget. It is this massive increase in new spending, not tax relief, that has created gaps between planned spending increases and available revenues.

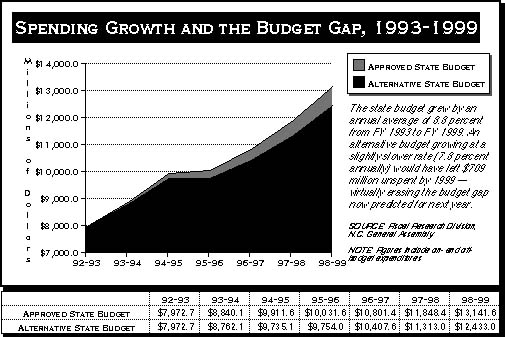

A simple calculation demonstrates the folly of the state’s reckless spending habits during the 1990s. According to legislative staff, court settlements and other pressures will create a nonrecurring budget gap of up to $800 million in FY 1999-00. The recurring budget, allowing for continuation as well as the Hunt administration’s planned teacher pay and Smart Start expansions, is facing a smaller gap in the range of $150 million to $250 million.2 If the legislature and administration had simply restrained spending growth by 1 percent per year since 1993, there would be more than $700 million in additional revenues in 1999-00 — erasing most of the problem.

The problem isn’t tax cuts or even court orders. It’s Raleigh’s addiction to spending.

John Hood, President